Add to it when you wish, refer to it when special purchases are to be made.

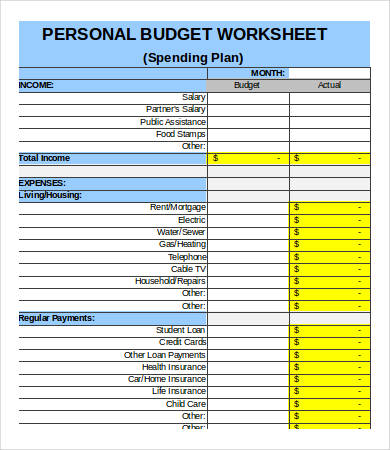

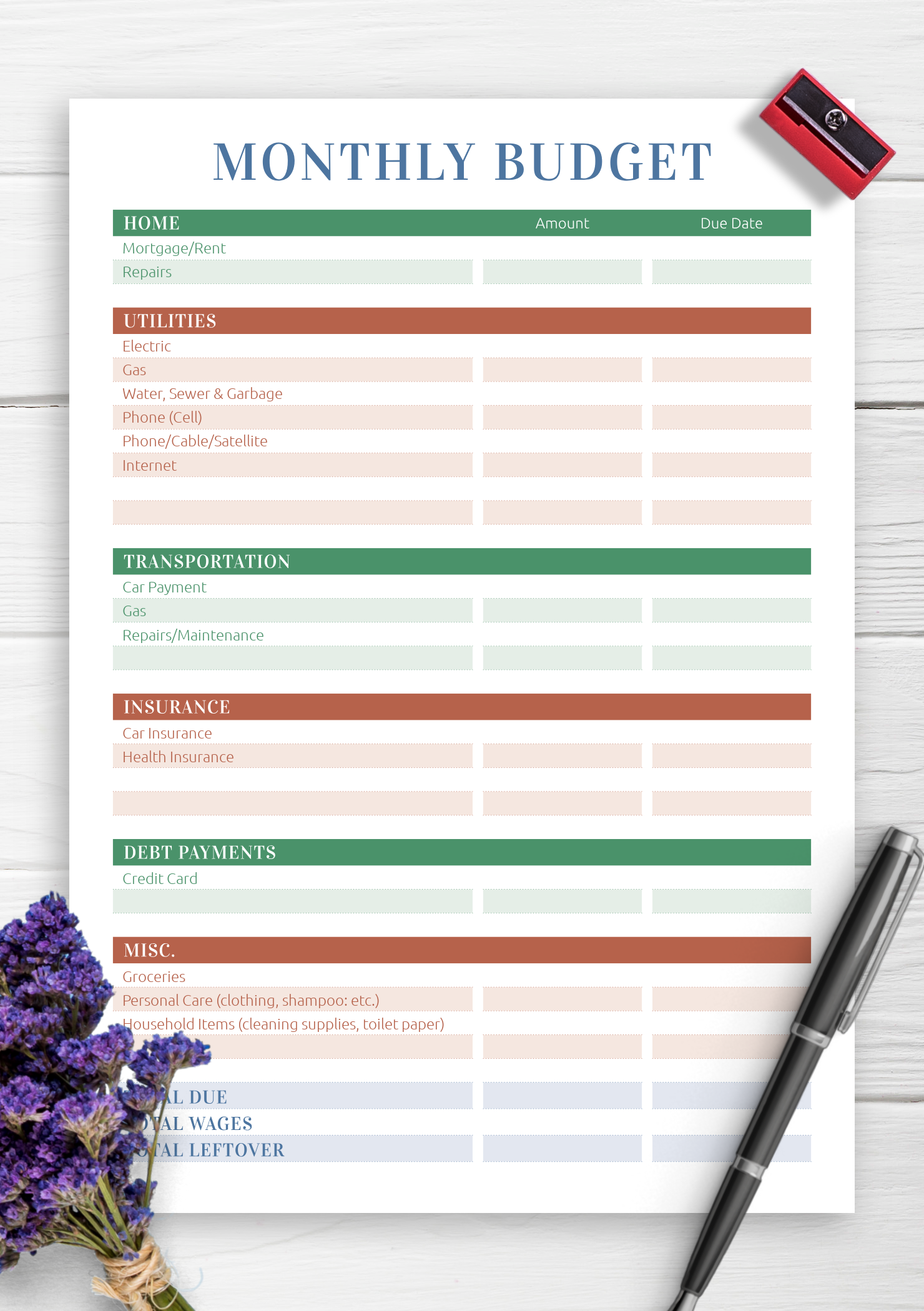

Categorize your expenses These categories may be housing, transportation, or food, for broad categories, or may get more specific, where you categorize car payments, car insurance, and gasoline separately.To budget for such bills by month, divide the bill total by the number of months the bill covers. Other expanses may be quarterly (four times per year) or semiannual (twice per year). Some expenses are yearly, such as insurance or property taxes. This allows you to determine your maximum expenditures per month. It even includes child support and gifts. This income may from paychecks, investments, or freelance work. Set your income baseline Determine all the sources of income you will have.This will give you an idea of your current habits. Track your income and expenses Review your income and expenses for the past 6 months to a year.The following are steps that can be used to create your monthly budget. Getting started, though, begins well before you find an app. There are several budget-creating tools available, such as the apps Good budget and Mint, and Google Sheets. You will be able to track your progress, which will help you to prepare for the future by making smart investment decisions. A budget is an estimation of income and expenses over some period of time. You should view creating a budget as a financial tool that will help you achieve your long-term goals.

Over time, you will adjust not only the numbers, but the categories. While creating a budget may seem intimidating at first, coming up with your basic budget outline is the hardest part. You do not want to just get by, and you do not want the problems associated with overdue balances, rising debt, and possibly losing something you have worked hard to obtain. You also may want to save money for large purchases or retirement. You want to have enough income to pay not only for the necessities, but also for things that represent your wants, like trips or dinner out. Designing your budget will help understand the financial priorities you have, and the constraints on your life choices. But do you have one?Ĭreating a realistic budget is an important step in careful stewardship of your financial health. Companies have them, individuals have them, your college has one.

“We need to figure out our budget and stick to it.”Ī budget is an outline of how money and resources should be spent. Create a personal budget with the categories of expenses and income.

Personal budget outlines professional#

(credit: “Budget planning concept on white desk” by Marco Verch Professional Photographer/Flickr, CC BY 2.0) Learning ObjectivesĪfter completing this section, you should be able to: Figure 6.7 Calculating a budget is important to your financial health.

0 kommentar(er)

0 kommentar(er)